alphaAI Capital

Let AI handle your investments, so you can focus on more important things like binge-watching shows.

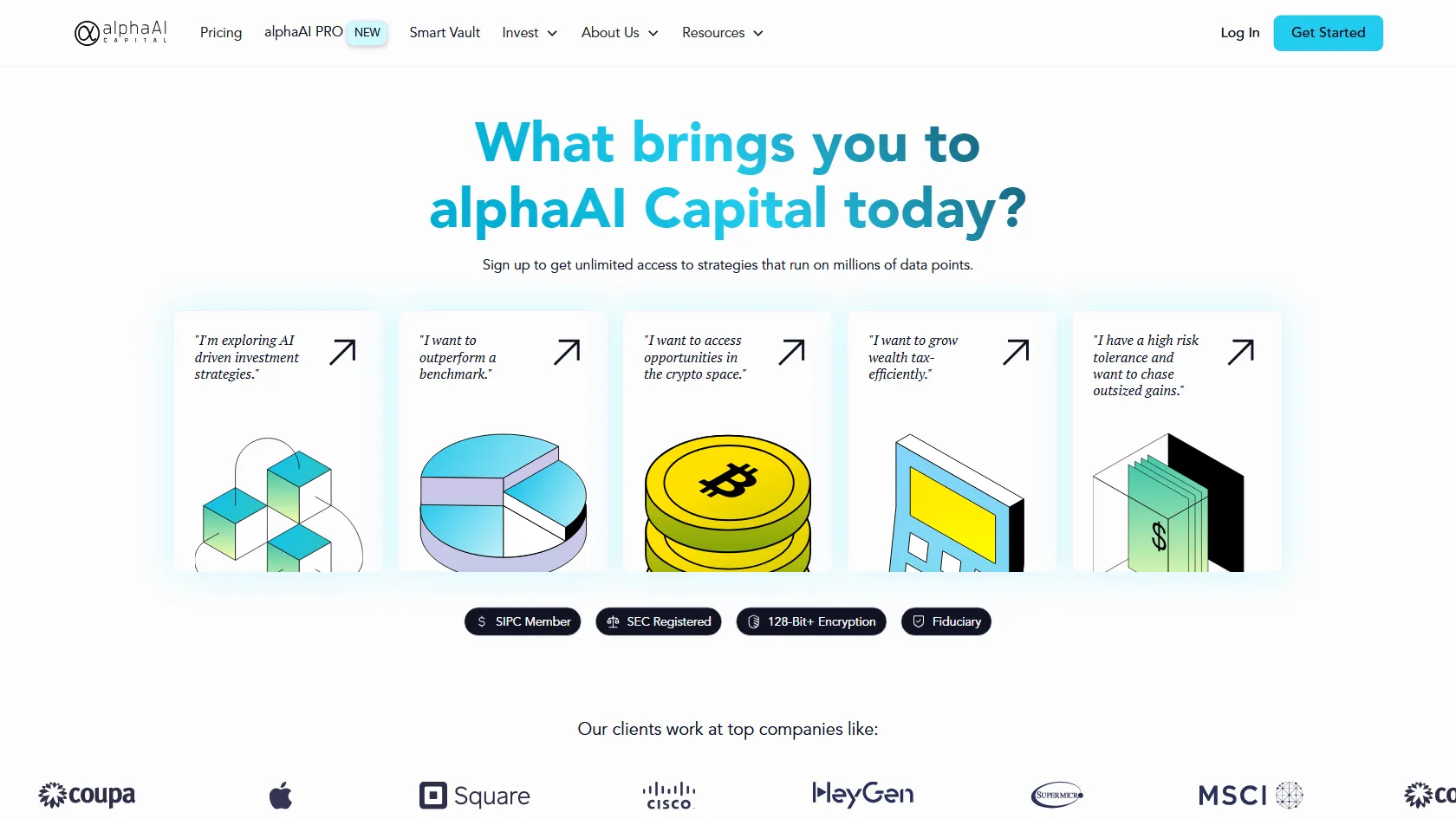

alphaAI Capital is an AI-powered roboadvisor that automates investment management using predictive machine learning. It adapts portfolios in real-time to market conditions, offering strategies like leveraged ETFs, crypto ETFs, and tax-aware long-short approaches to maximize returns while minimizing risks.

Paid

$9/month

How to use alphaAI Capital?

To use alphaAI Capital, sign up and define your investor profile by answering questions about your risk tolerance and goals. The AI then recommends and customizes a portfolio, automatically adjusting it based on market modes like Surge or Defense. It handles all trading and risk management, allowing you to monitor performance hands-off.

alphaAI Capital 's Core Features

alphaAI Capital 's Use Cases

alphaAI Capital 's Pricing

Standard Plan

$9 per month

For accounts between $1,000 and $20,000, includes automated ETF strategies, dynamic portfolio adjustments, and responsive downside protection.

Premium Plan

0.5% of AUM per year

For accounts exceeding $20,000, offers 0.5% of AUM per year, with all features including leveraged ETFs, crypto strategies, and personalized portfolios.

alphaAI Capital 's FAQ

Most impacted jobs

Financial Advisor

Investor

Entrepreneur

Retiree

Software Engineer

Consultant

Doctor

Teacher

Marketing Manager

Student